In its latest report, Does Size Matter, Preqin examines whether the size of a buyout fund significantly impacts returns. According to its latest investor survey “over half of LPs see small-size and mid-market buyout funds as currently presenting the best opportunities in private equity.” Despite this view, private equity buyout fundraising is dominated by a relatively small number of fund managers raising the majority of capital. According to Preqin, “of the 191 buyout funds closed in 2014, which raised a collective $186bn, eight mega and 27 large-sized buyout funds accounted for 70% of all capital, accumulating over $130bn.” Average buyout fund sizes have been creeping up in recent years, with the median fund size having reached its highest ever annual level ($400mn) in 2014.

In its latest report, Does Size Matter, Preqin examines whether the size of a buyout fund significantly impacts returns. According to its latest investor survey “over half of LPs see small-size and mid-market buyout funds as currently presenting the best opportunities in private equity.” Despite this view, private equity buyout fundraising is dominated by a relatively small number of fund managers raising the majority of capital. According to Preqin, “of the 191 buyout funds closed in 2014, which raised a collective $186bn, eight mega and 27 large-sized buyout funds accounted for 70% of all capital, accumulating over $130bn.” Average buyout fund sizes have been creeping up in recent years, with the median fund size having reached its highest ever annual level ($400mn) in 2014.

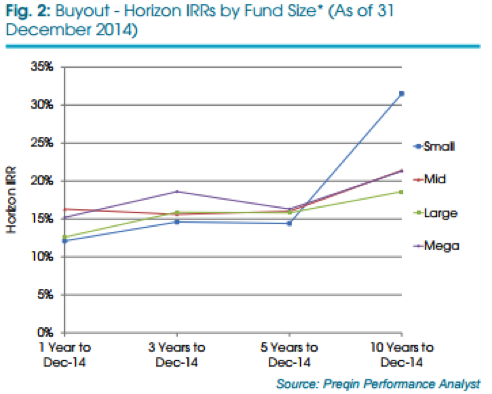

By calculating horizon IRRs over the short, medium and long term, Preqin concludes that different size groups exhibit varying levels of success. “There is no clear proof to suggest that buyout funds of one size range generally outperform or underperform those of other sizes, and in particular, no evidence to support a view that small-sized and mid-market buyout funds have outperformed larger buyout vehicles.”

Others conclude differently. Research conducted by PERACS’ Dr. Oliver Gottschalg as well as Dr. Ralf Gleisberg and Ramun Derungs of Akina, the European lower and middle-market investment adviser to private equity programs, provides some insight.

Drs. Gottschalg and Gleisberg and Mr. Derungs found that large-cap funds substantially underperform portfolios made up of mid-cap and in particular of small-cap funds. They observed a related trend when it comes to performance dispersion, with large-cap funds having a lower return dispersion than small-cap funds. On average, a small and mid-cap portfolio of 15 funds paid out a return of 1.71x versus 1.67x for a large-cap fund. To review the study directly, see Size matters – small is beautiful.

Preqin’s Does Size Matter also points out that “the key for investors lies in selecting the best fund managers, of any fund size, based on careful data analysis and due diligence.”

Here PERACS agrees. PERACS has performed a number of analyses on the importance of fund manager selection and its effect on private equity return performance.