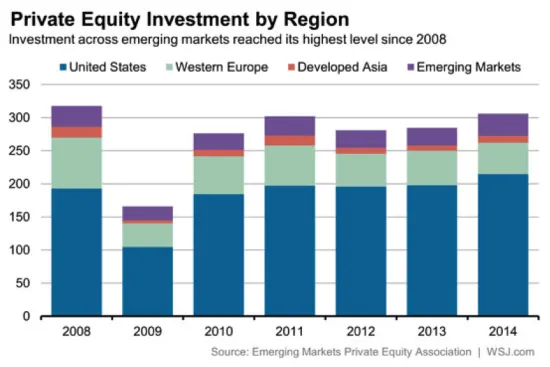

Private equity in emerging markets had a boom year in 2014, with investment as a percentage of global private equity investment growing to 11%, according to the Emerging Markets Private Equity Association (EMPEA). 2014 was a strong year for private equity in developed regions as well. For investors interested in the asset class, viable private equity in both emerging markets and developed economies offers a wide spectrum of investment options. So where is selecting the right manager most important – developed or emerging markets?

Private equity in emerging markets had a boom year in 2014, with investment as a percentage of global private equity investment growing to 11%, according to the Emerging Markets Private Equity Association (EMPEA). 2014 was a strong year for private equity in developed regions as well. For investors interested in the asset class, viable private equity in both emerging markets and developed economies offers a wide spectrum of investment options. So where is selecting the right manager most important – developed or emerging markets?

Research from PERACS’ Oliver Gottschalg and Francesco Castellaneta of the Catolica Lisbon School of Business and Economics investigated this question and found “significant differences between the relevancies of the PE Firm Effect for buyouts in developed and emerging economies. A PE firm’s resource endowment appears to be more important and more imperfectly mobile in developed than in emerging markets.”

Developed economies have greater access to capital, more potential acquirers including investment banks, family offices and other strategics, and more sophisticated financial institutions to facilitate such transactions. All of these contribute to increased competition, and thus there is a greater stress placed on a firm’s investment selection or operational improvement abilities.

Emerging markets on the other hand have a lower level of competition for deals. ”There may be relatively many ‘low-hanging fruits’ (i.e. opportunities to increase the expected value of a given business based on relatively simple value creation strategies) and comparatively few possible acquirers for these companies. In such a situation, the marginal impact of some PE firms’ unique abilities to implement additional and more complex value creation strategies will be small.”

To learn more about the PE Firm Effect, read Gottschalg and Castellaneta’s paper, “Does Ownership Matter in Private Equity? The Sources of Variance in Buyouts’ Performance”, which was recently published in the Strategic Management Journal.