There were $29 billion in private equity deals in the first quarter of 2015, according to the Financial Times. This is the lowest level since 2009 and half of what it was just a year ago. Of the 10 biggest private equity deals, seven were below $2 billion. If Q1 was a slow start for the industry, what does this mean for the rest of the year?

Exits

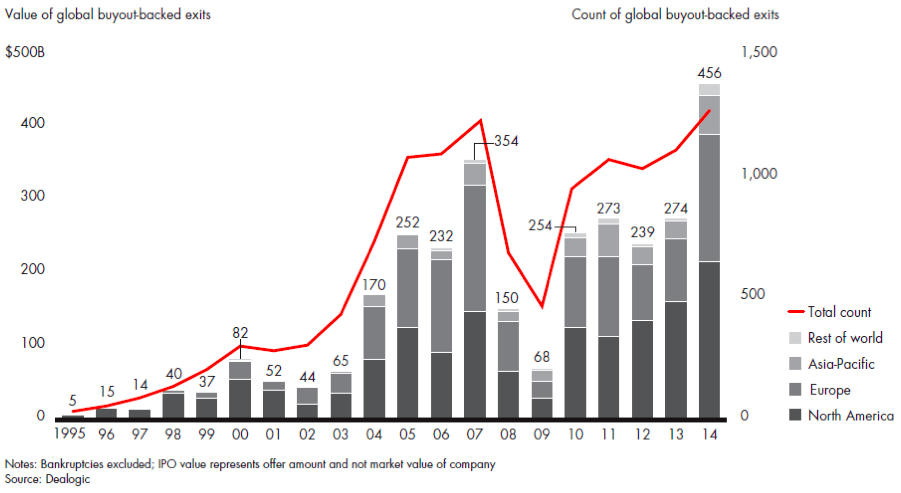

There is no doubt that 2014 was “The Year of the Exit.” Last year, with more than 1,250 transactions, buyout exits generated $456 billion in returns for private equity firms according to Bain and Co.’s 2015 Global Private Equity Report. While continued high valuations in the public markets have maintained a great environment for exits this year (European PE seeing the best Q1 exits since 2007 according data by the Centre for Management Buyout Research), firms are a bit hesitant to ink deals which has allowed for dry powder to build up to $1.2 trillion globally.

Despite Headwinds, Investors keep the faith

Despite Headwinds, Investors keep the faith

In addition to high valuations and dry powder, firms have their eyes on a few key variables. Although interest rates will inevitably increase, the Federal Reserve’s FOMC has indicated that these increases will be less aggressive compared to their projections from the end of last year. Leveraged loan volumes and lower debt levels are also likely to limit available capital to win deals and be put to work post acquisition. Despite all of this, investors believe in the private equity asset class and the returns it can generate for their portfolios.

Both the magnitude and consistency of those returns have reinforced LPs’ conviction that their PE investments were meeting or exceeding their expectations. A recent survey by Preqin, the alternative assets data provider, found that just 8% of LPs felt PE had fallen short, compared with 19% that had expressed some disappointment just three years ago. And with near unanimity, LPs believe that PE markets will continue to outperform public markets in the future, even as they anticipate that the performance gap will narrow in the wake of five years of steady stock market gains. With that faith in PE, it is little wonder that 84% of LPs responding to the Preqin survey said they planned to maintain or increase their PE allocation. As one LP we interviewed last fall put it, “I don’t know where else you would put capital.” (Bain & Co. 2015 Global Private Equity Report)

Winning the race requires “focus”

Rising market valuations will make dealmaking a bit more difficult, yes. However, these rising tides will not make companies impenetrable for acquisition. The economy’s invisible hand with its sticky fingers will provide target opportunities for fund managers who are focused and can leverage not only the companies they acquire, but also their ability to create lasting, transformative value.

At the core of a well-tuned alpha model is a PE firm’s clear articulation of where it will play and how it will win. It draws a tight ring around the investment areas where it is confident it will find success and where it will hunt for the majority of its deals. It determines how it will win by looking across the entire investment value chain to map out an angle of attack that makes the most of the firm’s unique strengths—from sourcing deals and conducting enhanced due diligence to applying a robust portfolio value-creation model and nimbly managing the exit process. In today’s investing environment, those firms that hone a repeatable model for value creation in their portfolio companies will outpace the rest. (Bain & Co. 2015 Global Private Equity Report)