What’s the role for ESG in institutional investing and private equity? Does the trend towards responsible investing — and responsible portfolio management — matter to investors?

More evidence that the answer is “yes.”

Plan Sponsor reports: “Forty-three percent of institutional investors incorporate environmental, social and governance (ESG) factors into their investing, up from 22% in 2013, according to a new report from Callan, “2018 ESG Survey.” Sixty-four percent of endowments incorporate ESG, up from 35% in 2013.”

The post highlights growth among corporate funds with:

- “20% of them using ESG in 2018, up from 14% in 2013”

- “39% of public funds incorporate ESG, up from 15% in 2013”

- “56% of endowments incorporate ESG factors, up from 22% in 2013”

- “72% percent of large funds, those with $20 billion or more in assets, incorporate ESG factors”

Further, 22% of investment managers indicate would like to see more ESG-focused product offerings in private equity.

Reports WealthManagement.com: “actively employing ESG operational practices guided by the framework within a private equity portfolio gives the fund its best chance of outsized returns. By using an ESG mindset in operating businesses, the private equity firm makes its portfolio companies attractive places to work in a world where the labor force is increasingly wary of working for PE firms. We believe that winning on talent is the best way to win on investments.”

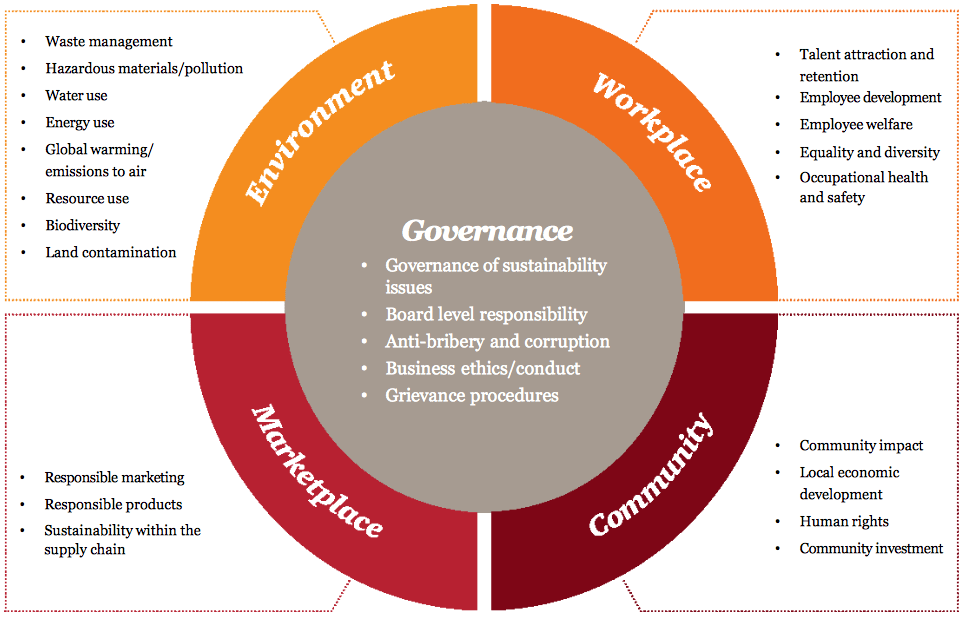

So what can PE firms do? PWC published a report titled “ESG considerations for private equity firms.” One question it asks: “What are the different elements of ESG reporting? As the name suggests, private equity has traditionally remained ‘private’ and has not reported non-financial issues. However, that stance is changing:

- “Public perception of the industry remains poor following the financial crisis and other high profile incidents in portfolio companies.”

- “‘Soft’ regulation is growing, for example, the Walker Guidelines for Disclosure and Transparency in Private Equity.”

- “Demand for non-financial reporting is rising from a range of stakeholders e.g. from investors, industry initiatives and the public.”

Some of the growth — and increased demand for offerings — seems inspired by personal interest.

PlanAdviser reports that “Demand for ESG investing is coming from both younger investors and wealthy investors who want to make a difference with their wealth. Cerulli says that 45% of U.S. households have an interest in ESG investing but that flows into these products to date have been modest—suggesting an untapped market. Furthermore, 47% of those with more than $5 million in assets express a preference for ESG investing.”

Another reason PE firms may want to increase their ESG focus — WealthManagement.com adds: “Taking an active role in implementing ESG-like operational policies is one of the most important things your PE firm can do, because it puts you in the best position to win the talent game, which, in turn, best positions you to win the returns game. Beyond being the right thing to do, it’s the right way to win.”