The Emerging Markets Private Equity Association recently reported that GPs raised just $676 million in Latin America during the first quarter of 2016, a decline of 56%, year-over-year. As this large and diverse investment market becomes increasingly volatile, LPs struggle to find a meaningful benchmark to identify strong emerging market players and rank them against their peers.

The Emerging Markets Private Equity Association recently reported that GPs raised just $676 million in Latin America during the first quarter of 2016, a decline of 56%, year-over-year. As this large and diverse investment market becomes increasingly volatile, LPs struggle to find a meaningful benchmark to identify strong emerging market players and rank them against their peers.

The majority of private equity benchmarks are less than perfect for many reasons. For instance, current benchmarks often compare funds of the same vintage groups, even though similar vintage funds more often than not have very different investment foci. Also, other methods of “peer” group selection are either arbitrary (such as fund size, geography) or largely subjective (such as “middle market”). Moreover, when comparing funds based on these characteristics, little account is taken for market dynamics that accompany similarly-focused funds competing for similar deals in related industries.

With these shortcomings in mind, Dr. Oliver Gottschalg developed an alternative metric, the PERACS Relevant Peer Benchmark, an innovative private equity performance benchmark based on empirically-derived “relevant peer funds” that draw on the analysis of a fund’s acquired underlying assets, not superficial characteristics of the fund itself (such as vintage year, geography or fund size). The benchmark leverages this investment data to identify “relevant peer funds” or “strategic cells” against which an assessment of comparative performance can be reasonably based.

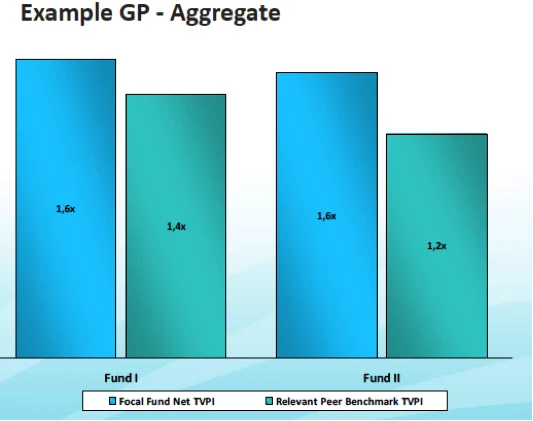

Relevant Peer TVPI Benchmark

Once the peer group has been established, the performance figure for the typical peer can be calculated and compared against a target fund to be analyzed. The resulting Relevant Peer Benchmark for a fund is the average performance of its “relevant peer funds,” weighted by their similarity to the fund in focus.

By using the Relevant Peer Benchmark, the comparative performance of a target fund is understood against competitors making similar investments, not a basket of private equity firms of largely arbitrary relevance. The PERACS Relevant Peer Benchmark works well in developed markets but is particularly germane in emerging markets where there is a wide dispersion of geographies and investment styles in a vast, global data set.

To listen to Dr. Gottschalg discuss using the PERACS Relevant Peer Benchmark to identify effective emerging markets managers, please click on this link: EMPEA LP Education Benchmarking Webcast.