The nature of risk management and what exactly it means for businesses today has expanded just as the global economy has increased. It used to be that risk management simply meant corporate governance and staying within regulatory requirements and frameworks. Today, risk management actually reveals formerly hidden value within companies that can be monetized. “Many organizations understand that achieving their strategic objectives is inextricably linked to their ability to manage risk and harness opportunity,” according to KPMG.

EY found the top 20 percent of companies with mature risk management systems implemented created three times the level of EBITDA as those companies within the bottom 20 percent. “Financial performance is highly correlated with the level of integration and coordination across risk, control and compliance functions. Top-performing companies understand that risk needs to be embedded as part of an organization’s DNA. When it comes to strategy deployment and execution, it’s important for risk to enable business performance – not simply to protect the business” The consultancy also found that risk management technology presents the greatest opportunity – or conversely Achilles heel – for an organization.

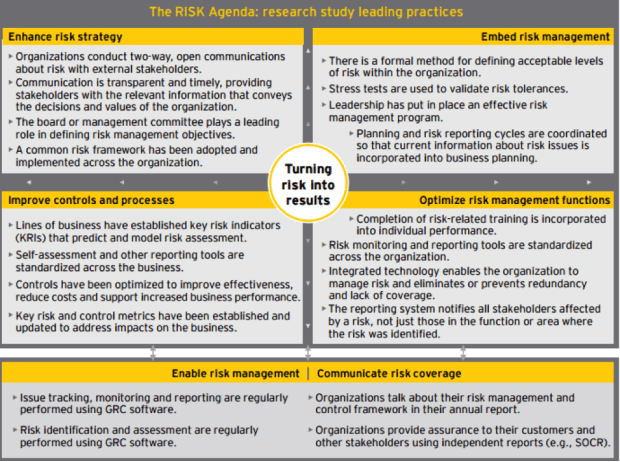

Companies typically achieve results from risk management through three inter-related ways.

- Risk Mitigation means that a company has the ability to identify and address key risk areas and at the same time be nimble enough to quickly close those gaps.

- Cost Reduction is a common goal for companies in today’s volatile market and that includes expenses put toward risk management.

- Value Creation component includes ways that risk management can improve business performance, such as improving controls around key processes, using data and analytics to optimize decision-making and even earning superior returns on risk investments.

For managers to have a 360 degree understanding of his or her company’s risk model, there needs to be a clear picture of the external environment, “all of the factors outside of the business that can affect it,” according to Study.com. While the global economy increases businesses’ earning potential within new markets, these same companies find themselves at greater risk than ever from third parties. Typical risk factors include economic, legal, political and technological. Many companies look towards grc software to help with their risk management, ensuring that they are able to work within their board of corporate governance.

Effective risk management starts at the top of the organizational chart. That means proper oversight and accountability should be in place at the board and executive levels. From there, risk management will flow through the rest of the company. Managers and other executives will play key roles in implementing risk management. “Effective reporting and oversight ultimately improve strategic decision-making.” By improving risk management processes, companies can become leaner and more agile while also insulating themselves from external threats. Deployment of resources will become more efficient while unlocking resources to pursue strategic business goals.