Well known science fiction author Ray Bradbury once said, “Living at risk is jumping off the cliff and building your wings on the way down.” After many years of “jumping off,” private equity is finally building “wings,” a set of metrics to evaluate the risk and volatility inherent in its business. For years, other asset classes have used risk metrics and benchmarks to gain greater insight into the quality and reliability of their returns. In this respect, private equity has been behind the times.

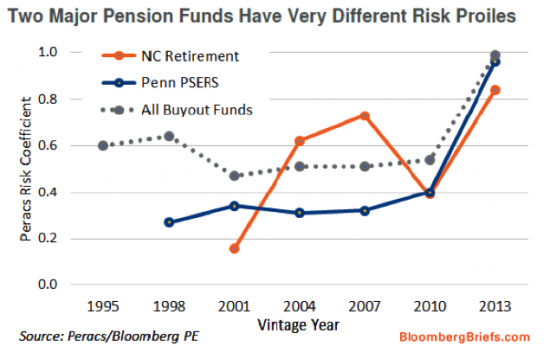

Considering how many public employee pension plans rely on private equity to meet their obligations, this is good news. Recently, PERACS and Bloomberg research analysts used private equity returns data compiled by Bloomberg to conduct a comparative risk/return study of the performance of two major pension funds, Pennsylvania Public School Employees’ Retirement System and North Carolina Retirement System. Each had distinct risk/return profiles and compare differently to an overall buyout risk benchmark. To read more about the research and its coverage, click here.

This comes at a time when private equity’s need for greater understanding of its own performance has become acute. Recently, CalPERS came under fire for not knowing exactly how much profit it had shared with its general partners. The Sacramento-based pension fund recently announced that “CalPERS’ external investment partner have realized $3.4 billion from profit sharing agreements,” (Calpers) an admirable start to a more sophisticated understanding of its underlying private equity funds.