This month marks the fifth anniversary of the creation of the Financial Stability Oversight Committee (FSOC), which was established by the Dodd-Frank Wall Street Reform and Consumer Protection Act to “identify threats and risk building in the financial system, including by identifying non-bank financial firms that could pose serious danger to the financial system in a crisis,” according to Victoria McGrane. “Those firms can be designated ‘systemically important’ by the group and brought in for tougher regulation by the Federal Reserve.”

McGrane reports on one of the biggest challenges to the FSOC’s authority: “MetLife Inc.’s decision to sue the federal government for labeling the insurer ‘systemically important.’”

“MetLife says the FSOC’s decision to label it as a so-called SIFI is premature since the rules governing insurers aren’t yet written. But the company’s fate as SIFI has long been predicted. FSOC — and indeed Dodd-Frank — was created in part because of concerns that insurers — particularly American International Group Inc. — had fallen into a regulatory gap and were not being watched closely enough by the federal government… MetLife is the first to decide to challenge the FSOC’s decision in court.”

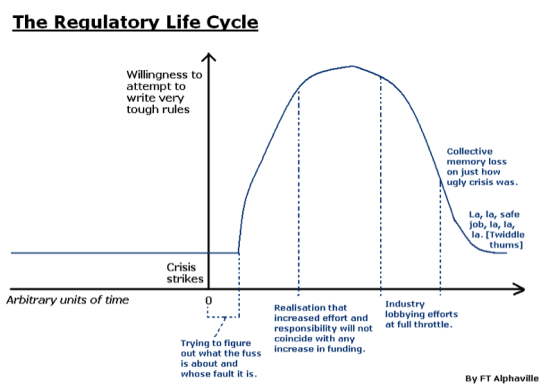

Better Markets uses the chart below from FT Alphaville to explain why MetLife’s challenge is so important.

“MetLife and its industry allies are hoping that the public and leaders in Washington have forgotten about the huge surprise that AIG’s failure was seven years ago. Without warning, AIG’s sudden failure posed a lethal threat to the financial system, and it took hundreds of billions of dollars to prevent AIG’s failure from precipitating a second Great Depression. If MetLife’s lawsuit succeeds in crippling the FSOC’s mission or authority, then once again no one will be responsible for reviewing and analyzing the threats posed by systemically significant nonbank financial institutions. These serious threats to the U.S. financial system will go unregulated, just as they did in the years before the 2008 financial crisis. Limiting the FSOC’s authority to identify these risks would put taxpayers back on the hook for future AIGs and other unexpected threats to our financial system, lead to more bailouts and increase the odds of another catastrophic financial crash.”