Lyle Denniston analyzes the oral arguments in Federal Energy Regulatory Commission v. Electric Power Supply Association, a case currently before the Supreme Court that “affects billions of dollars in the nation’s market for electricity, and could affect whether the nation’s power grid collapses in a blackout or at least a brownout.”

“Since the Constitution was adopted, the United States has always had two levels of government — a national government that handles things which affect the states collectively, and state governments that look after matters within their borders. But it is not always easy to know where the dividing line is, even when Congress tried to describe one. The FERC case is a near-perfect illustration of that difficulty: where did Congress draw the line for regulating the price of electricity — in producing it and in delivering it to the ultimate user? Who oversees the wholesale and retail prices, respectively, especially when each quite naturally affects the other?” This is an issue collectively for states, and for states individually, for instance, Texans could have some of the cheapest energy plans available when looking at the likes of TXU plans or others from other providers, when compared to someone looking for an energy plan within Connecticut, for example.

“Solicitor General Donald B. Verrilli, Jr., who had a stellar career in handling such issues when he was a private lawyer, was notably confident as he defended FERC’s authority to write a rule that has the economic effect of persuading the ultimate users of electricity to cut back their demands at peak periods… But he had barely started when Justice Anthony M. Kennedy, in the role of ‘a student in Economics 101,’ would concede that what happens in each side of the market — wholesale and retail — would affect the other. If that were what was at stake, Kennedy told Verrilli, ‘you win the case.’ But, switching to the role of judge, he said the federal law governing FERC draws a distinction in regulatory power, and so ‘we have to make the distinction between the end of federal power and the beginning of local power.’”

“In further comments by Kennedy and Scalia, and by remarks or questions from Chief Justice John G. Roberts, Jr., it seemed that, for them, FERC was losing on the question of its authority — that it may well have crossed a federal-state dividing line. If that is where those three wind up, it seems entirely likely that they would attract a fourth vote: that of Justice Clarence Thomas, who remained silent as usual but is generally a skeptic of robust federal authority. On the other side, Justices Stephen G. Breyer, Elena Kagan, and Sonia Sotomayor participated in ways suggesting that they could be counted on FERC’s side. It seems likely that they would attract the vote of Justice Ruth Bader Ginsburg, who spent the hour listening. In that event, the Court could be divided evenly. By custom, that results in a simple order saying that the lower court ruling — here, by the U.S. Court of Appeals for the District of Columbia Circuit — had been upheld. It would not stand as a precedent, but it would be a distinct loss for FERC.”

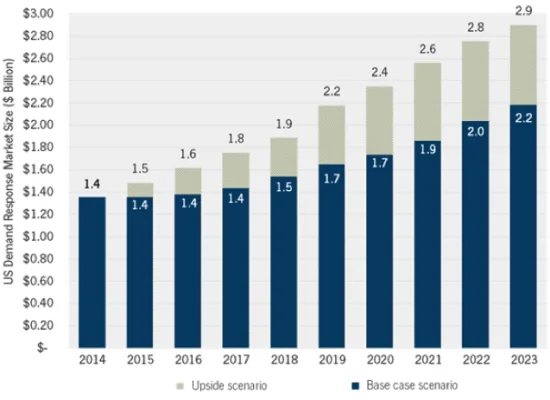

Utility Dive lays out how the Supreme Court’s ruling on FERC’s so-called “demand response” policy could affect the electricity market.

“If the D.C. Circuit’s decision is upheld, the “markets will continue on their current paths pushing to implement alternative rules to incorporate demand side management resources,” according to Ben Kellison, director of grid research at GTM Research… Feldman and Kellison posited that the states could take ownership over demand response at the retail level, pointing to New York and California as two states that are already doing so… An upheld decision, however, would be a clear boon to the bottom line of many generators. If the D.C. Circuit decision holds, ‘competitive generators are likely to maintain a greater premium on generation during peak periods and higher barriers to entry from DSM into any market,’ Kellison said.”

“However, if the decision is reversed, many say a return to the status quo is most likely in the short term… If a reversal were to take place, demand response providers ‘are likely to pull back from efforts to resaturate the capacity market that have occurred in the wake of nullification of the order’… Competitive generators, on the other hand, would likely see their ‘margins shrink during peak days as more flexibility from DSM enters the market,’ Kellison said.”

“However, if the decision is reversed, many say a return to the status quo is most likely in the short term… If a reversal were to take place, demand response providers ‘are likely to pull back from efforts to resaturate the capacity market that have occurred in the wake of nullification of the order’… Competitive generators, on the other hand, would likely see their ‘margins shrink during peak days as more flexibility from DSM enters the market,’ Kellison said.”