Understanding performance in private equity starts with quantifying the source of returns. Not all returns are created equal. Some firms ride the market; others make operational improvements; others rely on financial engineering; yet others, a combination of everything.

Understanding performance in private equity starts with quantifying the source of returns. Not all returns are created equal. Some firms ride the market; others make operational improvements; others rely on financial engineering; yet others, a combination of everything.

Much is made of the role that financial leverage plays in boosting PE returns. Since all firms use it to some degree, the impact of leverage is important to understand because the use of leverage can mask, or otherwise distort, a firm’s underlying performance. Understanding the effect of leverage helps answer the question of whether your GP’s performance compares favorably to other firms as well as other asset classes? In addition, it is essential in understanding the underlying riskiness of a firm’s performance.

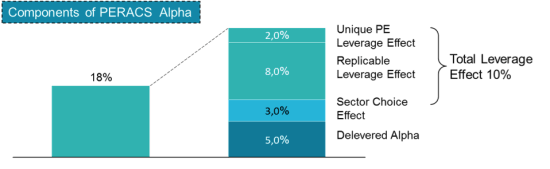

PERACS Alpha helps break down the components of performance. Leverage is a big part of this; two of the four components of PERACS Alpha are related directly to leverage.

First, PERACS Alpha established the Leverage Effect on performance. This is the portion of returns attributable to the difference in leverage between the PE portfolio and the leverage of the sector-choice-adjusted Public Market Equivalent (“PME”) investment strategy (i.e. actual sector leverage). The Leverage Effect can be further broken down into:

- the Replicable Leverage Effect, i.e. the incremental return over the sector-choice adjusted PME investment strategy (with actual sector leverage) that could have been achieved by ‘leveraging-up’ the sector-choice adjusted PME investment strategy to a level of financial leverage that corresponds to the PE portfolio; and,

- The Unique PE Leverage Effect, which can be seen as the added performance from incremental leverage on Delevered Alpha.

Second, PERACS Alpha calculates Delevered Alpha, the difference between the returns to a sector-choice adjusted PME investment strategy (with actual sector leverage) and the de-levered PE returns, i.e. simulating PE performance based on a level of financial leverage that corresponds to the gearing of the publicly-traded sector peers.

Finally, PERACS Alpha looks at the Effect Of Sector Choices, i.e. the incremental return over the broad stock index return (with actual index leverage) that would have been achieved by replicating the PE portfolio’s industry mix in a PME investment strategy (with actual sector leverage).