The private equity industry has come a long way from the buyout boom era of the mid-2000s. As mega-deals like Energy Future Holdings ($47bn) or Harrah’s Entertainment ($30 bn), both of which have filed for bankruptcy, have become virtually non-existent and banks have introduced stricter lending policies, GPs have had to reevaluate their strategies.

The private equity industry has come a long way from the buyout boom era of the mid-2000s. As mega-deals like Energy Future Holdings ($47bn) or Harrah’s Entertainment ($30 bn), both of which have filed for bankruptcy, have become virtually non-existent and banks have introduced stricter lending policies, GPs have had to reevaluate their strategies.

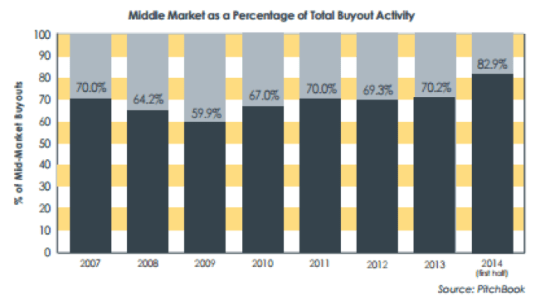

Many firms are looking towards the middle market in search of attractive deals with a greater upside potential relative to the larger market. They believe there is a “larger universe of investible companies, there is relative inefficiency in how these companies are bought and sold, and there is more opportunity for growth” (P&I) In the first half of 2014, a staggering 82.9% of total buyout activity was dedicated towards the middle market according to CohnReznick’s Momentum 2015: Middle Market Private Equity Outlook, a more than 20% increase in the past five years. The number of total deals in the middle market increased over 150% between 2009 and 2014.

“The middle market—and the lower middle market in particular—was once viewed as a cottage industry by private equity, garnering interest solely from firms targeting the market sector,” said Jeremy Swan, a principal in CohnReznick’s Private Equity and Venture Capital Practice. “Today, however, PE firms are much more comfortable doing deals in the middle market as well as the lower middle market. Even big name private equity brands like the Carlyle Group and Berkshire Partners are devoting more capital and energy to the middle market as they expand their horizons in their quest for quality deals and exciting growth opportunities.“

LPs are eager to get into the middle market. According to private equity data provider Preqin, “the highest proportion of investors remain interested in small to mid-market buyout funds, with 49% of surveyed investors believing this fund type presents the best investment opportunities.”

While the middle market might be the place where private equity managers can find deals, the bigger question at hand is whether its place to find ample returns. Research conducted by PERACS’ Oliver Gottschalg as well as Dr. Ralf Gleisberg and Ramun Derungs of Akina, the European lower and middle-market investment adviser to private equity programs, provides some insight.

They found that large-cap funds substantially underperform portfolios made up of mid-cap and in particular of small-cap funds. They observed a related trend when it comes to performance dispersion, with Large-cap funds having a lower return dispersion than small-cap funds. On average, a small and mid-cap portfolio of 15 funds paid out a return of 1.71x versus 1.67x for a large-cap fund.

Size matters – small is beautiful.