There are critics of private equity who say it is an expensive asset class and believe that they can avoid private equity fees by mimicking private equity investments in the public markets to deliver similar returns.

There are critics of private equity who say it is an expensive asset class and believe that they can avoid private equity fees by mimicking private equity investments in the public markets to deliver similar returns.

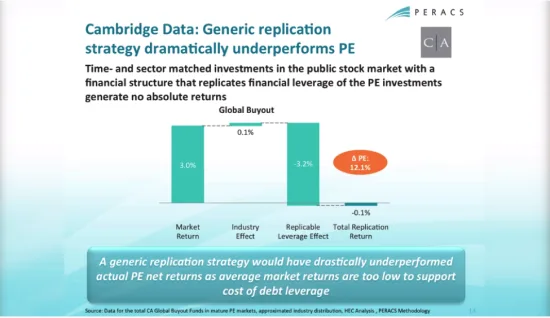

What would the results be for an investor trying to replicate private equity investing by making investments in the broad public market with the same rhythm, leverage and industry focus of private equity? Would an investor be able to deliver similar results as private equity funds?

Research conducted by members of the PERACS team analyzed 615 funds and 50,000 cash flows over a 30 -year period to find out. They concluded that an investors’ broad market strategy would return approximately 3%; which, when taking into account the cost of debt that buyouts typical use, resulted in an overall negative leveraged performance. In other words, the returns aren’t enough to service the debt.

PERACS’s Oliver Gottschalg takes a closer look at the use of leverage in the video below.