Despite record distributions in recent quarters and investors looking to reinvest, many LPs still remain cautious over whether private equity as an asset class is too expensive, too aggressively financed or too susceptible to macroeconomic volatility as a result of liquidity limitations. It seems appropriate to discuss what these cautious fears come down to, namely risk.

Despite record distributions in recent quarters and investors looking to reinvest, many LPs still remain cautious over whether private equity as an asset class is too expensive, too aggressively financed or too susceptible to macroeconomic volatility as a result of liquidity limitations. It seems appropriate to discuss what these cautious fears come down to, namely risk.

All LPs want to better understand how risky the private equity class is as a whole, what the specific risk attributes of their private equity portfolio are and how much risk will a given GP add to their portfolio. Typically, LPs utilize a top down approach based on aggregate times series data. While this can provide some color, there are various issues and limitations to the insights that can be taken away. For instance, listed private equity vehicles lack fundamental attributes of those that are unlisted, their inclusion in calculating risk can lead to a possible overstatement of volatility and correlation of the asset class. In addition, use of times series data from private equity funds offers no consideration of individual transactions, industry segments or deal sizes.

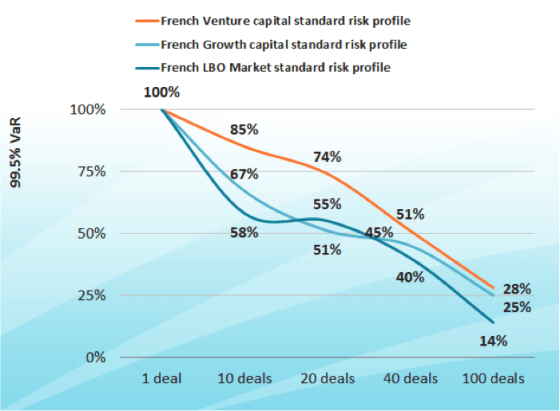

Dr. Oliver Gottschalg, Founder and Head of Research at PERACS, together with Dr. Bernd Kreuter, Managing Partner at Palladio Partners, have developed a new method of approaching risk which considers year-to-year change in portfolio company net asset values (“NAV”) and cash flows to build a bottom-up value-at-risk (“VaR”) model for deal and fund performance. In the first-ever assessment of private equity VaR based on deal-level data including the recent financial crisis, Drs. Gottschalg and Kreuter utilized data from the Association Française des Investisseurs Pour La Croissance (“AFIC”) consisting of over 3,400 deals made in France. In modelling the year-on-year VaR for portfolios, they employed various deal characteristics (stage, industry, age, size, performance to-date) for each of the underlying investments.

Their research found that for a portfolio made up of 100 French LBOs, investors were 99.5% likely to lose no more than 14% of their capital, a potential loss percentage substantially currently lower than assumed by the current regulatory regime. French Venture and Growth Capital investments were also found to be less risky than currently perceived by regulators.

PERACS’ Oliver Gottschalg will be presenting further findings from this research at the Super Return International 2015 in Berlin this week. Be sure to follow PERACS on Twitter and LinkedIn.