In 2014, private capital investors made an enormous leap in supporting new payment technologies and mobile banking. The Wall Street Journal reported that venture capital investment in the payment sector from 2011-2013 ranged from $776 million to $788 million world-wide, however in 2014 this skyrocketed, with payment-tech startups raising over $1.65 billion in 113 deals world-wide.

In 2014, private capital investors made an enormous leap in supporting new payment technologies and mobile banking. The Wall Street Journal reported that venture capital investment in the payment sector from 2011-2013 ranged from $776 million to $788 million world-wide, however in 2014 this skyrocketed, with payment-tech startups raising over $1.65 billion in 113 deals world-wide.

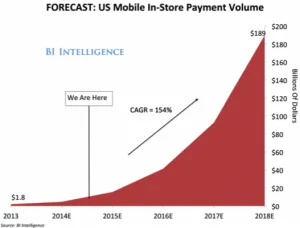

With the emergence of mobile services such as Apple Pay, Venmo, and Square and the increased demand for commercial banks to provide functional banking services on the go, the way consumers utilize and interact with their money is at an inflection point.

In order to keep up, banks will need to adapt. Chris Magnani, a consultant at Gallup, believes that going forward into 2015, “Community and regional banks will prioritize their investments in improving the user experience and functionality of technology, such as mobile apps, that quickly went from a luxury to necessity. Without these investments, banks will find it harder to achieve traditional goals such as branch migration or growing share of wallet.”

At that same time that mobile payments and banking services become more ubiquitous, there is a gradual realization of the expanded reach these offerings have. In a recent video post from The Verge, philanthropist Bill Gates discusses the impact that mobile technology can have on consumers across income brackets.