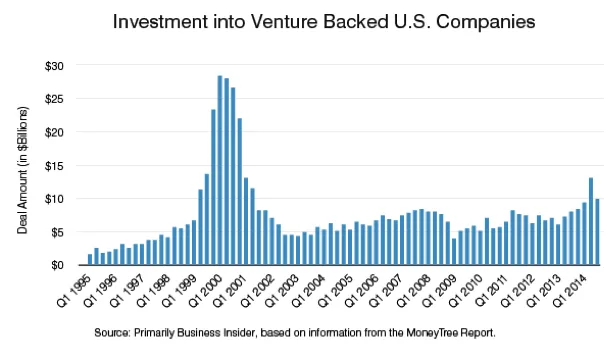

Data from Dow Jones’ Venture Source showed that in 2014 venture capital attracted $52.1 billion in investments, the most since 2000. Valuations for startups have also surged. In Q3 of 2014, the average deal value, as measured by share price, increased 115% according to Fenwick & West’s most recent Silicon Valley Venture Capital Survey. With private capital eager to find new opportunities, should entrepreneurs be eager to gain funding for their emerging companies from VCs, or should they bootstrap and remain focused on developing their products despite economic constraints?

William Hsu, Co-founder and Managing Partner at Mucker Capital, said, “Many wrongly believe that the most important step after ‘coming up with an idea’ is to raise funds. They often lament that they are caught in a ‘Catch-22’ between needing money to invest in the myriad things a company needs to get to market (salaries, customer acquisition, product development, etc.) and not getting going at all.”

William Hsu, Co-founder and Managing Partner at Mucker Capital, said, “Many wrongly believe that the most important step after ‘coming up with an idea’ is to raise funds. They often lament that they are caught in a ‘Catch-22’ between needing money to invest in the myriad things a company needs to get to market (salaries, customer acquisition, product development, etc.) and not getting going at all.”

“As a seed-stage VC, I am constantly telling entrepreneurs that they must bootstrap, stay lean, get to market quickly with a minimum viable product, iterate to find product-market fit, figure out unit economics, raise institutional capital and finally start scaling,” according to Re/Code.

More startups are taking Mr. Hsu’s advice and are bootstrapping these days. The Wall Street Journal reports that as of July 2014, “more than a quarter of small firms had no financing from outside sources, up from 16% when the economic recovery began in July 2009, according to a National Small Business Association survey.”

However, this isn’t stopping investors from lining up and trying to get skin in the game. Many smaller investors do not want to wait for the next big tech firm to go public for their first chance and are turning to alternative investing platforms. Gil Penchina “is part of an emerging group of investors who negotiate with upstart companies to buy equity stakes that are sold through so-called crowdfunding on websites such as AngelList. The other investors rely on his due diligence, and he gets 15% of any investment profits eventually earned by the groups, known as syndicates, that he leads,” the Wall Street Journal reports.

Though funding can be a great catalyst for growth, managing the relationship between investors and entrepreneurs is imperative to success. Alexis Ohanian, co-founder of Reddit, believes that VCs “who have done well, have done extremely well, and I hope it shifts VC to a better place where it realizes that founders have to be treated a certain way. It has to be founder friendly.”

The Private Capital Research Institute (“PCRI”) and the Brookings Institution will be sponsoring an event in Silicon Valley with host GSV Asset Management on Wednesday, April 1, 2015. Entitled, “Driving Growth with Big Ideas: Private Capital’s Role in Global Innovation” it will feature some of venture capital’s most prominent thought leaders and successful entrepreneurs.

To learn more about the upcoming event: CLICK HERE