Politico has a must-read piece on the largest financial institution in the United States.

“That bank currently has a portfolio of more than $3 trillion in loans, the bulk of them to about 8 million homeowners and 40 million students, the rest to a motley collection of farmers and fishermen, small businesses and giant exporters, clean-energy firms and fuel-efficient automakers, managed-care networks and historically black colleges, even countries like Israel and Tunisia. It has about 120 different credit programs but no consistent credit policy, requiring some borrowers to demonstrate credit-worthiness and others to demonstrate need, while giving student loans to just about anyone who wants one. It runs a dozen unconnected mortgage programs, including separate ones targeting borrowers in need, Native Americans in need, veterans in need and, yes, Native American veteran borrowers in need. Its problems extend well beyond deadbeat shipbuilders.”

“That bank, of course, is the United States government—the real bank of America—and it’s unlike any other bank.”

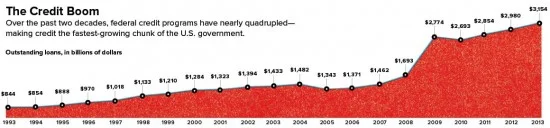

“These unregulated and virtually unsupervised federal credit programs are now the fastest-growing chunk of the United States government, ballooning over the past decade from about $1.3 trillion in outstanding loans to nearly $3.2 trillion today.”

“One reason for the bank’s explosive growth is old-fashioned special-interest politics, as beneficiaries of credit programs—the real estate industry, for-profit schools, the farm lobby, small-business groups, even shipbuilders—push aggressively to grow them. A Washington money spigot, once opened, is almost never turned off.”

This phenomenon is further explored in the book, Uncle Sam in Pinstripes by Douglas Elliot: “It is a long-held perception that America is a nation where the government typically stays out of day-to-day business activities. Yet the U.S. federal government is in many ways the biggest and most influential financial institution in the world, with $10 trillion in federal guarantees and loans going to the private sector.”