In the continual search for the elusive Alpha — the rate of return one can attain over a risk-adjusted benchmark index — a new piece in Columbia University’s The Curl suggests that angel investing may be the new new thing when it comes to alternative asset classes for investors.

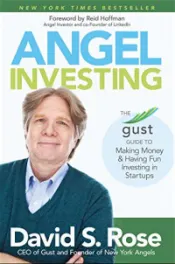

David S. Rose is founder of New York Angels and the CEO of Gust. He is also author of “Angel Investing: The Gust Guide to Making Money & Having Fun Investing in Startups” (Wiley, 2014). Rose writes: “Over the long run, carefully selected and managed portfolios of personal angel investments can produce an average annual return of more than 25 percent, which compares well to virtually any other use for your money. Even better, you often get a ringside seat at a venture that is out to change the world, direct access to company CEOs who may become the corporate magnates of tomorrow, and early access to the latest products and services before they become generally available.”

David S. Rose is founder of New York Angels and the CEO of Gust. He is also author of “Angel Investing: The Gust Guide to Making Money & Having Fun Investing in Startups” (Wiley, 2014). Rose writes: “Over the long run, carefully selected and managed portfolios of personal angel investments can produce an average annual return of more than 25 percent, which compares well to virtually any other use for your money. Even better, you often get a ringside seat at a venture that is out to change the world, direct access to company CEOs who may become the corporate magnates of tomorrow, and early access to the latest products and services before they become generally available.”

Rose offers various tips to proper angel investing, including:

- “Invest the same amount in each company”

- “Reserve additional capital for follow-on rounds”

- “Invest in a large portfolio of companies”

- “Be very careful about valuations”

But there also may be another way, according to Jeffrey M. Gallagher, CEO of Virginia Bio, a statewide trade group that promotes the scientific and economic impact of the Virginia life sciences industry. Gallagher says in the Richmond Times-Dispatch that one place to invest is in academic research:

“Returns on investment in academic research can be calculated, and the yields are significant to investors, be they taxpayers or the private sector. In the early 2000s, Virginia’s public universities leveraged $13 million from the Commonwealth Technology Research Fund into $167 million — a better than 6:1 return on investment. Today, the University of Virginia reports that it leverages state funds into federal research funds at a ratio of 8:1. In recent years, industry has funded about 4 percent of the commonwealth’s academic research, an investment of more than $55 million annually, according to National Science Foundation data.”