There is no “sure thing” when it comes to investing in private equity. There are numerous risks and variables to be accounted for and any investment has the potential to fall short of expectations. While there have been plenty of firms who have seen success in the private equity industry, not every manager has been able to repeat that success.

There is no “sure thing” when it comes to investing in private equity. There are numerous risks and variables to be accounted for and any investment has the potential to fall short of expectations. While there have been plenty of firms who have seen success in the private equity industry, not every manager has been able to repeat that success.

That said, some managers are better than others at navigating the ups and downs of the market, handling crises and finding ways to stay the course towards profitability. The questions each private equity institutional investor should be asking is, “How do I find these managers? Is there a means of evaluating GP to show if they have ‘the right stuff’ to repeat their successes?”

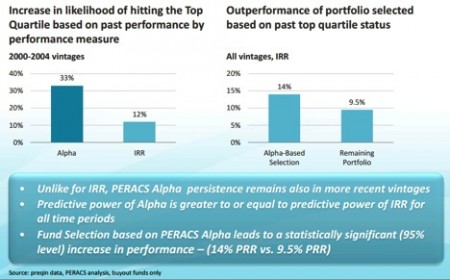

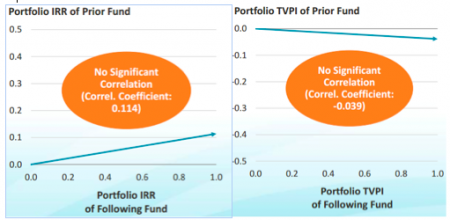

Historically, many LPs have turned to IRR to determine past top performers. But IRR has inherent inaccuracies that distort performance and recent academic research shows that it no longer give LPs a good indication of the likely future winners (maybe link to other’s articles to show that this is not home-made research only). LPs should rather look at variables that are leading indicators of future performance.

PERACS research has demonstrated that unlike IRR, PERACS alpha, holding periods and loss ratios are statistically significant predictors of subsequent performance. There is strong evidence for persistence at alpha level – certain fund managers are able to outperform the market in terms of alpha creation repeatedly. In addition, past alpha is not only a predictor of future alpha, it is also a predictor of future absolute returns – even if measured in terms IRR.