Getting a true accounting of the value of private equity investing has always been difficult. Whether measuring IRR or trying to compare funds across the same vintage, varying fund performance metrics and industry benchmarks have contributed to a number of the transparency issues facing the private equity industry as a whole. Multiple on Invested Capital (“MOIC”) is one of the most popular means for measuring a fund’s performance, however it does not account for opportunity cost.

One of the key characteristics of private equity investing is the asset class’s illiquidity. Because investors’ money is stuck in private equity regardless of the macroeconomic background at any given time, MOIC does not properly take into account what that money would be doing if it were invested in the stock market.

One of the key characteristics of private equity investing is the asset class’s illiquidity. Because investors’ money is stuck in private equity regardless of the macroeconomic background at any given time, MOIC does not properly take into account what that money would be doing if it were invested in the stock market.

In other words, to understand how well private equity performs one must understand how well the public market landscape is doing behind the scenes. If one makes 20% returns in private equity, but would have made 30% returns at the same time by putting your money in the stock market, that private equity firm probably didn’t do that well.

Work from PERACS, the private equity research and analytics group, accounts for this because from the LP perspective each Capital Call has an “opportunity cost,” where money is not available to be invested elsewhere until the corresponding distribution.

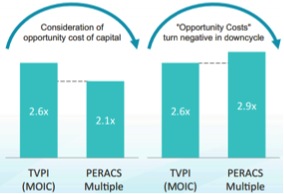

The PERACS Multiple explicitly considers this opportunity cost. The PERACS Multiple of each investment is calculated as a variable-rate profitability index, i.e. the ratio of present value of distributions over present value of takedowns, using the MSCI Global Index as discount rate, which captures large and mid-cap representation across 23 developed market countries.

If over the course of an investment the public markets were performing well, the PERACS multiple will take out the appreciation of the public market.

On the other hand, if the market under performs, a negative opportunity cost can result, leaving the investment less vulnerable to macroeconomic swings one of private equity’s advertised benefits.

Accounting for this opportunity cost removes some of the statistical noise and lays the foundation for an honest assessment of the investment class.

Prof. Oliver Gottschalg goes into further detail while presenting at the annual Conference of LPEQ, the Listed PE Association: