After years of sitting on the sidelines as an alternative asset class, venture capital is regaining its position as the darling of the private equity world. Recent successful VC investments like Facebook, Airbnb, Uber, and Tesla dominate the business press as commentators focus on the tremendous disruptive impact these businesses have on established industries, There’s also the hope that solutions to the world’s biggest problems – like energy, global warming, food security and continued space exploration – can spring from VC’s incubators of innovation, the MIT Technology Review reports.

The Financial Times notes that even Blackstone, Carlyle, and KKR, usually investing at much higher levels in the corporate food chain, have turned a keen eye towards Silicon Valley as tech savvy becomes a prerequisite for investing successfully in businesses of any size.

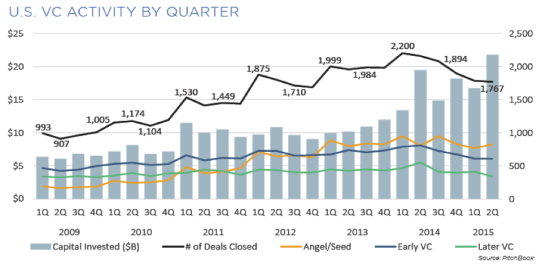

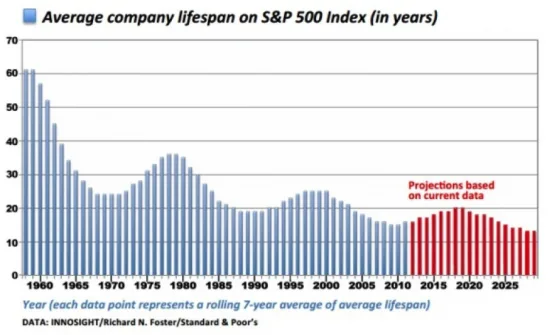

Some of these +$1 billion businesses – known in VC parlance as Unicorns – have achieved virtually overnight valuations equivalent to or surpassing the many decades-old businesses that populate the S&P 500. In fact, valuations are up across venture capital portfolios, not just at the higher end, and it is having strong, cascading effects on the industry. “Many more venture funds are raising capital than in recent history. The current pace in 2015 is expected to surpass 2014 in both total capital raised and number of funds closed.” As valuations increase and VC funds write more and larger checks, they must in turn raise more money themselves. VC capital deployment is not just bigger in volume but faster as well. The median time for investment rounds has shortened since its high point in 2009. This pattern is particularly pronounced in early stage fundraising, according to Pitchbook.

Some of these +$1 billion businesses – known in VC parlance as Unicorns – have achieved virtually overnight valuations equivalent to or surpassing the many decades-old businesses that populate the S&P 500. In fact, valuations are up across venture capital portfolios, not just at the higher end, and it is having strong, cascading effects on the industry. “Many more venture funds are raising capital than in recent history. The current pace in 2015 is expected to surpass 2014 in both total capital raised and number of funds closed.” As valuations increase and VC funds write more and larger checks, they must in turn raise more money themselves. VC capital deployment is not just bigger in volume but faster as well. The median time for investment rounds has shortened since its high point in 2009. This pattern is particularly pronounced in early stage fundraising, according to Pitchbook.

Venture capital performance is also a focus. In a recent study of venture capital performance conducted by Oliver Gottschalg, a professor at HEC Business School and founder of the leading provider of private equity quantitative analytics PERACs, the study found that Union Square Ventures, Avalon Ventures and Sparks Capital were the three best performing firms in 2015. Swiss VC firm Etsy was the only European VC firm in the top 10 listing. (Financial News)

However, 2015 may be a highpoint for the asset class. After steady growth in the number of rounds of VC funding since 2012, PE Hub notes the number of rounds closed in 2015 is on pace to fall short of the 2014 number. In addition, 2015 performance for mid-life VC funds has declined.