Recent stock market volatility has caused everyone to ask the question of whether the long-awaited public market correction is on the horizon. According to many market commentators, market volatility will be the new normal. Should private equity investors worry about their investments?

Recent stock market volatility has caused everyone to ask the question of whether the long-awaited public market correction is on the horizon. According to many market commentators, market volatility will be the new normal. Should private equity investors worry about their investments?

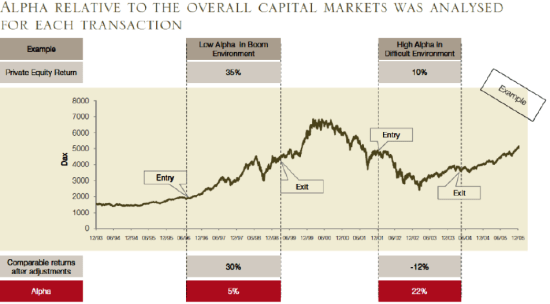

Dr. Oliver Gottschalg of PERACS, in collaboration with Golding Capital Partners, tried to answer this question. In a comparative study, they determined that private equity’s “alpha” or outperformance relative to public market equivalents was actually quite strong in market downturns but tapered off as the markets stabilized. PE’s alpha was smallest during heightened period of growth. The below graphic is an illustration of what this relative alpha performance might look like.

Using an expanded data set of realized transactions representing a distribution across geographies, industries and size categories, the starting point of the study was the calculation of private equity’s excess return compared with the stock market, by reference to the alpha generated by the private equity transactions. For a variety of reasons, the returns from listed shares and from private equity cannot be compared directly. This study enabled a comparison between the two asset classes by means of various adjustments. This is done by synthesizing a comparable investment in shares for every private equity transaction, which reflects:

- The timing effect, i.e. the timing of the cash inflows and outflows;

- The sector effect, i.e. the performance of the sector in which the company operates, and;

- The leverage effect, i.e. the gearing of the private equity investment compared with the publicly listed company.