How hot is the global M&A market?

The headlines call out the recent big deals. The latest big one: Nokia’s move to buy Alcatel-Lucent, which the Wall Street Journal said “creates new global networking behemoth. And beyond the big deals, it’s the volume: “First-quarter global M&A up 21 pct on bigger deals,” Reuters reports. Fortune reminded us that “U.S. M&A activity had its largest first quarter since 2000 with $414.7 billion, and it was the best first quarter ever for Asia (non-Japan) M&A with $199.7 billion.”

This, of course, leads to the next question: Can this momentum sustain?

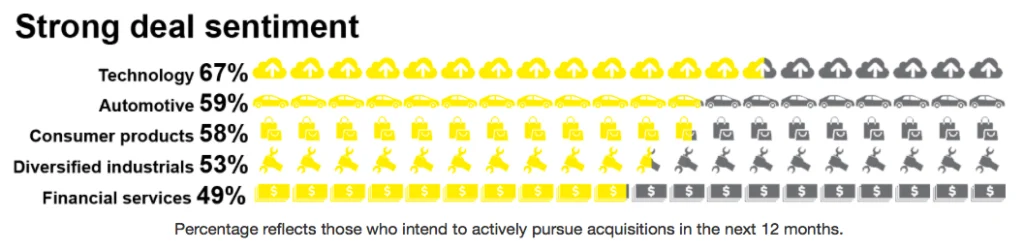

Ernst & Young jumps into the analysis with the 12th Edition of its excellent Global Capital Confidence Barometer. The headline: “For the first time in five years, more than half our respondents are planning acquisitions in the next 12 months, as deal pipelines continue to expand.”

Ernst & Young jumps into the analysis with the 12th Edition of its excellent Global Capital Confidence Barometer. The headline: “For the first time in five years, more than half our respondents are planning acquisitions in the next 12 months, as deal pipelines continue to expand.”

The survey outlines three reasons for the “sharp increase in dealmaking intentions”:

- “The arrival of new entrants — both startups and companies returning to the market after staying on the sidelines for several years.”

- “Divergent economic conditions are accelerating cross-border M&A, as existing momentum in many developed markets is further fueled by falling oil prices and currency fluctuation.”

- “Disruptive innovation is driving dealmaking at every level of the enterprise.”

The data also indicate that global corporate executives feel the momentum indeed will continue:

- “83% of executives view the economy as improving”

- “76% of companies are focused on innovative organic growth strategies”

- “56% of companies expect to pursue acquisitions in the next 12 months”

Some saw the trend building. KPMG reported in its 2015 M&A Outlook Survey: “Acquisition momentum is building.” The report stated: “Anticipating that economic and market conditions will remain positive in the U.S., an impressive 82 percent of respondents said they were planning at least one acquisition in 2015; 19 percent planned to make two acquisitions; 11 percent planned three acquisitions and ten percent planned 11 or more deals for the coming year. Respondents plan on doing multiple deals in 2015, reporting considerably more expected acquisitions than in previous years.”