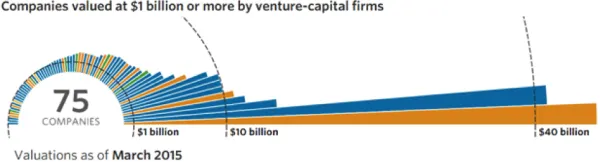

The “Unicorn,” defined as a VC investment with a billion-dollar-plus valuation, is a term coined by Cowboy Ventures’ Aileen Lee in an article posted in Tech Crunch in November 2013. What once seemed unattainable, however, has in a short period of time become almost commonplace with over 75 VC-backed startups valued at over a billion dollars.

Fortune: “Now there are herds of unicorns,” says Jason Green, a venture capitalist at Emergence Capital Partners whose investments include Yammer, which sold to Microsoft for $1.2 billion.

While Unicorns can seem glamorous and garner enormous press, they can also become crowded and later investments tend to generate lower returns. In fact, only 27% of the investments made by VCs in Unicorns have been “fund makers” – an investment that pays back the entire value of its fund, a kind of measuring stick in the VC world. In other words, most VCs investing in Unicorns are not coming away with outsized returns. Why? According to a recent piece in Forbes, “many of the investors in these companies are big funds that came in at later stages and high valuations, paying a big price for a small share. Hence, they got a piece of the glory, but they did not earn a high multiple on capital for investors.”

So where do VCs find returns if not in Unicorns? The answer: Dragons. A Dragon is an investment that is extremely profitable – a “fund maker,” but is not valued over a $1 billion. Because Dragons tend to fly under the radar, they are more difficult to find than Unicorns and their investment dynamics are different. “You cannot ‘buy your way’ into a dragon late in its life because at that point the remaining upside is unlikely to return your entire fund. You have to find dragons when they are young,” says John Backus in a recent article in Tech Crunch.

The co-founder and managing partner at NAV.VC concludes that, “Unicorns are for show. Dragons are for dough.”

Aileen Lee is on the steering committee of an event sponsored by the Brookings Institution and Private Capital Research Institute, a group dedicated to furthering the understanding of private capital and its global economic impact. The event, to be held in Redwood City at GSVlabs this April, is entitled, “Driving Growth with Big Ideas: Private Capital’s Role in Global Innovation.” To learn more about the PCRI, its mission and the event click here.