It is, of course, the measure that all investors seek — alpha, the common measurement of financial performance when considering a risk-adjusted basis.

Now a new working paper questions to what extent alpha measures skill. The study, “Impediments to Financial Trade: Theory and Measurement,” seeks to “model the effects of information asymmetry on both the performance of securities portfolios and on international financial trade. [The] researchers identify informational frictions, which produce impediments to financial trade, and apply their theory to explain international asset allocations,” according to the University of Chicago’s Capital Ideas Blog.

Further, the paper explores a compelling concept: To what extent do information inefficiencies act like a tax? The blog reports that the research explores assets in “informationally inefficient markets” and determines that the lack of information acts like a tax “tax on their prices that drives returns lower. Because of that, identical assets (in terms of their fundamentals) can have different returns based on the informational efficiency of the markets where they trade.”

The results, according to the researchers, just might go to the heart measuring the value of alpha: “We use this tax equivalence of frictions for two applications, the first theoretical and second empirical. First, we assess the value of the widely used ‘alpha’ measures for inferring informational frictions, and in particular the informational advantage of certain investors. We find that there is no simple, one-to-one relation between informational advantage and alpha and discuss alternatives.”

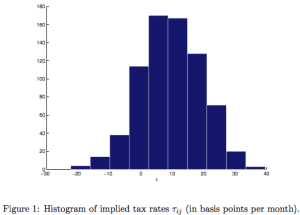

“Second, using the broad equivalence between financial frictions and shadow tax rates, we develop a methodology to infer these shadow tax rates jointly from observed portfolio allocations and returns.”

Given their research, then, does alpha measure skill? The answer may come in a section the authors title “Alpha does not measure skill.” They write: “This paper develops a new methodology to measure impediments to financial trade. Taking the view that financial frictions act as shadow taxes (a view consistent with, but not confined to, an asymmetric-information motivation), we utilize data on cross-country portfolios to obtain and study patterns in implicit tax rates. These tax rates can be useful for a host of applications, such as providing guidance for the sources of frictions that seem most promising in explaining the data, quantifying the importance of some factors (such as the size of the financial industry) in reducing shadow tax rates, providing benchmarks for models that generate valuation wedges across different investors, etc. Additionally, and importantly, our measure of frictions is expressed in economically meaningful units and is easily interpretable.”

The conclusion, the authors state, is clear: “This paper develops a new methodology to measure impediments to financial trade. Taking the view that financial frictions act as shadow taxes (a view consistent with, but not confined to, an asymmetric-information motivation), we utilize data on cross-country portfolios to obtain and study patterns in implicit tax rates. These tax rates can be useful for a host of applications, such as providing guidance for the sources of frictions that seem most promising in explaining the data, quantifying the importance of some factors (such as the size of the financial industry) in reducing shadow tax rates, providing benchmarks for models that generate valuation wedges across different investors, etc. Additionally, and importantly, our measure of frictions is expressed in economically meaningful units and is easily interpretable.”

The University of Chicago blog’s conclusion is equally direct: “Informational efficiency might be one other bit of alpha being a dubious measure of skill. Given what money managers charge for alpha, it may be expensive clothing indeed.”