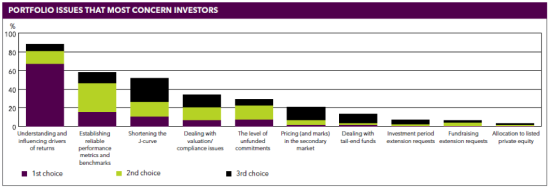

A survey recently conducted by Private Equity International (PEI) asked private equity investors what issues concerned them the most. U.S., European and Asian investors were unanimously worried about understanding drivers of returns, followed by establishing better performance metrics and shortening of the J-curve. This is the second year in a row that investors voted ‘understanding and influencing drivers of returns’ as the top concern, highlighting the fact that LPs are increasingly interested in measuring, understanding and replicating such performance in their own portfolios.

A survey recently conducted by Private Equity International (PEI) asked private equity investors what issues concerned them the most. U.S., European and Asian investors were unanimously worried about understanding drivers of returns, followed by establishing better performance metrics and shortening of the J-curve. This is the second year in a row that investors voted ‘understanding and influencing drivers of returns’ as the top concern, highlighting the fact that LPs are increasingly interested in measuring, understanding and replicating such performance in their own portfolios.

Establishing reliable performance metrics and benchmarks ranked number two as a chief investor issue. With volatile global performance and keen focus on understanding their own risk exposure, investors are voicing their demands for more reliable performance data from fund managers. This, however, can be a struggle.

PEI’s report commented that, “Performance reporting methods tend to vary so much between different managers that for a large LP with a diversified portfolio and an extensive list of GP relationships, it’s increasingly difficult to compare different funds against each other with any degree of reliability.”

Investor’s demands have attracted the attention of the US Securities and Exchange Commission over the past year which has looked into a number of issues ranging from how firms can claim top quartile status to how operating partners are compensated. Any action taken by the SEC could very likely impact how managers report fund performance in the future.

PEI131_Perspectives_digital.pdf by TDGoddard