Working Capital Conversations: Leading thinkers, practitioners and experts discuss the ideas that drive global business.

Working Capital Conversations: Leading thinkers, practitioners and experts discuss the ideas that drive global business.

Frequently in business, we hear about the cost of environmental improvements – how they may change requirements in building, plant and equipment, raise expenses, and ultimately, increase consumer prices as the added investment costs get passed to you and me.

But what about the money to be made? Increasingly, to borrow a phrase, the economics of environmental improvement strategies can mean good things to smart investors. The so-called “clean environment” sector is now a well-defined, if not potentially rich opportunity for the smart investor.

So what does this sector look like? What areas within the sector are investment ready – and present sustainable investment opportunities – as opposed to simply green fads? And when we think about innovation in the environment, can private investment spur public action – or is it the reverse?

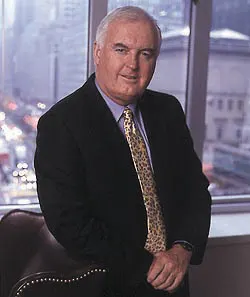

Few have been more active in defining, solving, and investing in environmental improvement strategies than Carter Bales, Chairman & Managing Partner, NewWorld Capital Group, a private equity firm investing in the Environmental Opportunities sector primarily in the U.S. and Canada. Bales previously served at McKinsey, where he founded several of their practices, including environmental management. He helped prepare their 2007 report: “Reducing U.S. Greenhouse Gas Emissions: How Much at What Cost?,” and he’s co-author of the Foreign Affairs piece “Containing Climate Change.” Bales serves on the boards of multiple leading environmental organizations, including The Center for Market Innovation at the Natural Resources Defense Council and The Nature Conservancy.

[soundcloud url=”https://api.soundcloud.com/tracks/223865377″ params=”color=ff5500&auto_play=false&hide_related=false&show_comments=true&show_user=true&show_reposts=false” width=”100%” height=”166″ iframe=”true” /]