The SEC’s new rule requiring companies to disclose the ratio of CEO pay to that of the median employee unleashed a flood of praise and criticism. The New York Times notes the rule goes into effect on Jan. 1, 2017, “over strenuous opposition from the U.S. Chamber of Commerce and other corporate lobbying groups. But there was also support for the rule from investors, individuals, academics and advocacy groups.”

But it also highlights some reasons it might reduce outsized executive pay. “Although institutional investors will probably continue to look the other way on executive compensation, the disclosure of a pay gap may encourage other stakeholders to act differently.”

The Atlantic points to an alternative: Lynn Stout’s recommendation that limiting corporations’ ability to deduct executive pay from their taxes would have a far larger impact.

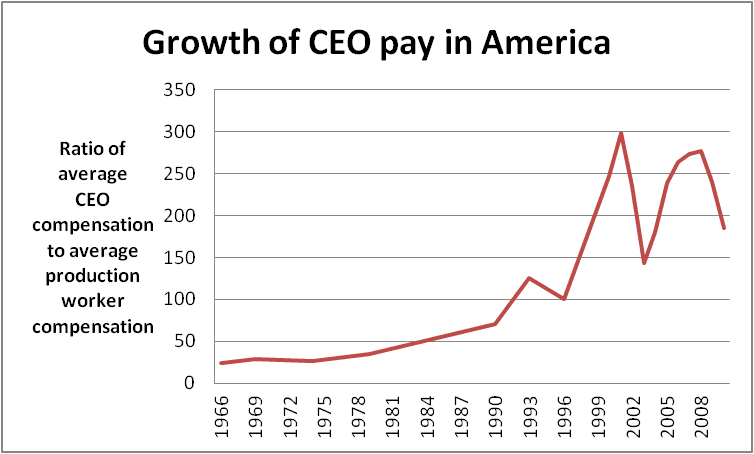

“In Stout’s view, the rise in CEO pay can be attributed to a change in the tax code back in 1993. After the change, in order for companies to be able to keep deducting executive pay as a business expense, they had to tie compensation to a measurable metric. They settled on some proxies for shareholder returns.”

Yale Insights talked with Stout about executive compensation and the role of shareholder value in setting direction in corporations.

Said Stout: “I think, after 20 years of trying to perfect the idea of so-called objective performance metrics, we still haven’t gotten it down. I’m fond of the bad old days when we gave CEOs a million dollars and an executive jet. It cost less and it seems to have produced better results.”