Developing nations and emerging markets, particularly those that rely upon exports, continue to feel the pinch of lower prices for commodities, including oil, and the specter of higher interest rates, but there is one place bucking the trend. The World Bank notes that with “an expected growth of 7.5 percent this year, India is, for the first time, leading the World Bank’s growth chart of major economies.”

The issue faced by many emerging market economies is their dependence on exporting oil and other commodities. Furthermore, governments have generally been slow to diversify their countries’ revenue streams. “Lower prices for oil and other strategic commodities have intensified the slowdown in developing countries, many of which depend heavily on commodity exports.”

It is not just that India, Asia’s third-largest economy, is an oil importer and that the country has benefited from lower energy costs; proactive regulatory reforms aimed at reducing red tape have been added to that equation with great success. “The government’s efforts to remove structural bottlenecks is lifting investor confidence and improving the business climate, making India an attractive destination for both domestic and foreign investors,” according to PressTV.

Compared with the global economy, which is expected to expand by 2.8 percent this year, it is easy to see why investors inside and outside of India are so excited about the country’s predicted future. “In India, new reforms are improving business and investor confidence and attracting new capital inflows, and should help raise growth.”

India, in fact, is expected to surpass China as the world’s fastest growing economy.

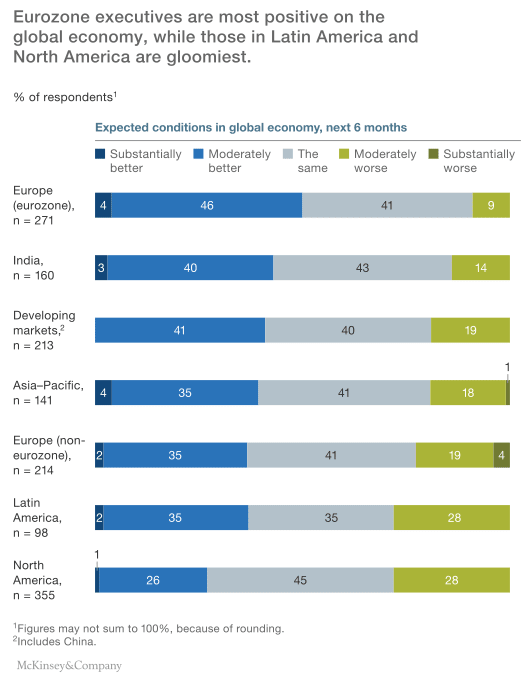

While emerging market executives have generally been down this year in assessing their home economies, India, not surprisingly, remains the most bullish. Executives there are still much more upbeat than those everywhere else.

To be sure, while investors in emerging markets have their sights set on India the future is not entirely gloomy for all developing economies. McKinsey & Company notes that “emerging-market executives are more optimistic in the long term than their developed market peers. They are twice as likely as developed-market executives to rank ‘global synchronicity’ as the most likely outcome for the decade ahead.”