Martin Neil Baily and Sarah Holmes write for the Brookings Brief that things are – and have been for decades – changing among the “Big Four” banks: JPMorgan Chase, Citibank, Bank of America and Wells Fargo. But since the financial crisis in 2008, things have gotten worse and policymakers aren’t paying attention to what it means to the overall U.S. economy.

Prior to the crisis, these four banks reported profits of about 2 percent of assets and then they lost money in 2008. They have been able to return to profitability since then, however they have not returned to the pre-crisis level of return on assets, averaging a return of about 1 percent of assets in 2014. Of course, each of the Big Four banks has performed differently in this area. For example, Wells Fargo reported profits of about 2.5 percent of assets before the crisis and averaged a return of about 2 percent of assets in 2014. Citibank, on the other hand, reported profits of about 2 percent of assets before the crisis. That number plummeted to nearly -3 percent of assets during the crisis, and even in 2014 remains only at 1 percent of assets. Bank of America reported profits of about 2 percent of assets before the crisis; their returns on assets fell to 0 in the wake of the crisis, and only approached 1 percent of assets in the last two years. Compared to these banks, JPMorgan Chase reported relatively flat returns on assets over the past decade.

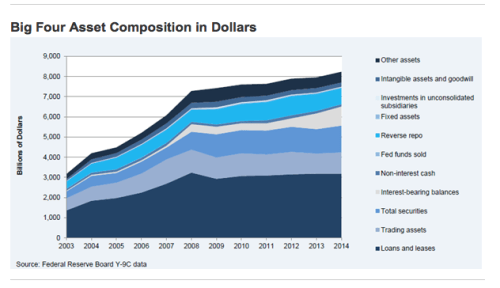

Although the deregulation and then the financial crisis caused the big four banks to increase their share of total banks assets and liabilities as a share of total banking, it is not by as much as previously believed and in fact, since 2010, the share of banking sector assets held by the Big Four banks has declined. This trend is likely to continue in light of regulatory pressure and capital requirements.

Their research shows a troubling decline in loans in relation to deposits, meaning banks have the ability to make loans but aren’t. This may be due to concerns about risk or restraints resulting from new regulatory pressures. But loans are crucial to getting the economy to function and grow and they don’t seem to be happening as much as our economy needs.

You can download their full paper or a summary.