Garnering capital commitments from Limited Partners is no easy task. Yet, investors are still happily reinvesting their recent returns from a surging exit environment with the right managers.

Garnering capital commitments from Limited Partners is no easy task. Yet, investors are still happily reinvesting their recent returns from a surging exit environment with the right managers.

CalPERS is a prime example. This large public investor recently announced that it would be reducing the number of private equity GP relationships it holds by up to two-thirds. “The decision by CalPERS may not immediately result in a drop in overall commitments to private equity funds, but serves as an effective statement to fund managers on the importance of justifying fund terms, as well as the power of the limited partner.” (Preqin)

The hurdle for LPs reducing their managers is separating the outperforming from the mediocre. The hurdle for GPs is understanding their own performance on a deep level and conveying that to prospective and existing LPs. In short, for GPs it’s about breaking up performance into its constituent parts – understanding exactly the source of returns, not just the overall return. Why do LPs want to know HOW performance was generated? Because it sheds light on whether returns are consistent and repeatable.

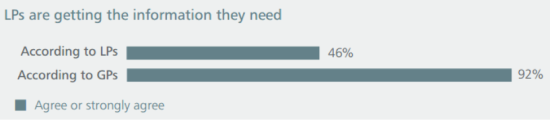

A report on The Reputational Risk in Private Equity conducted by IAG UK stated, “The greater competition faced by GPs is a strong incentive to deliver exceptional service during fundraising.” The report also found that there was a significant divergence between GPs and LPs regarding receiving necessary information. While 92% of GPs believed that LPs are getting the information they need, only 46% LPs believe they are receiving the necessary information.

One firm on the forefront of transparency is Doughty Hanson & Co. Go to their Annual Review 2014 to see how PERACs is helping Doughty Hanson demonstrates its source of returns.