When investing in private equity, investors like to have a sense of predictability. While historical returns are at the forefront of an LP’s radar, understanding a fund manager’s strategy and its consistency is also extremely important.

When investing in private equity, investors like to have a sense of predictability. While historical returns are at the forefront of an LP’s radar, understanding a fund manager’s strategy and its consistency is also extremely important.

A desire to understand predictability is becoming more prevalent among investors, as many are beginning to substitute commitments to large generalists GPs for more specialized funds. “Some of the best opportunities today are in specialist private equity funds that stretch the boundaries of the asset class.” (Forbes)

As high valuations make deals harder to find, dry powder is accumulating and GPs are starting to make changes to their strategy that might help put capital to work in a difficult deployment environment. The “huge supply of capital explains why buyout managers are increasingly focusing on particular sectors and geographies where they have strong track records, real expertise and hence few serious competitors. It also explains why a growing number of private equity managers are developing expertise in less traditional areas where there clearly isn’t enough capital to satisfy demand.” (Forbes)

The question remains: As LPs further select focused fund managers, is there a means to determine that GPs are consistent with their traditional or stated strategies? Analysis from PERACS provides some insight on this matter.

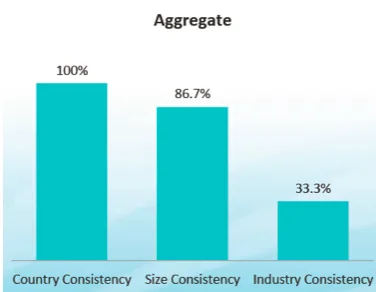

No matter what strategy GPs may choose, investment consistency can be executed by GPs operating at very different ends of the deal spectrum. By breaking investments down by geography, size and industry, we can see if a GP’s investments stay within its “strike zone” or if the GP is “chasing deals.”

PERACs will conduct an assessment of the difference in characteristics between the investment made in the last 5 years and those made in the last 6 to 10 years. With this, they will determine the consistency of investments across these three criteria – country, size and industry.