In times of crisis, liquidity and exiting investments is on the minds of panicking investors across asset classes. They are seeing their returns erode and are likely to be making “safer” market bets to preserve capital. While the long term investment horizons and capital tie up of private equity might not look like a viable option during a crisis, it is worth taking a more detailed look.

In times of crisis, liquidity and exiting investments is on the minds of panicking investors across asset classes. They are seeing their returns erode and are likely to be making “safer” market bets to preserve capital. While the long term investment horizons and capital tie up of private equity might not look like a viable option during a crisis, it is worth taking a more detailed look.

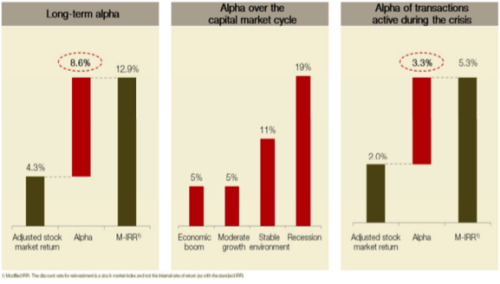

Research conducted by PERACS’ Oliver Gottschalg in collaboration with Golding Capital Partners sought out to find whether long-term alpha, alpha through the cycle and alpha during the crisis for private equity were stable.

By analyzing approximately 5,600 worldwide deals from the past 30 years they determined that private equity transactions active at the peak of the financial crisis, though they were below the long term average, generated an alpha of 3.3% compared with the adjusted stock market return. They found that the private equity asset class maintains positive overall alpha for the entire cycle and, in fact, that alpha was anti-cyclical and stable throughout the financial crisis environment 2008.

The report concluded that, “private equity funds are capable of supporting their companies to the greatest effect when they are most in need of assistance.”